Our Nj Cash Buyers Diaries

Our Nj Cash Buyers Diaries

Blog Article

Some Known Details About Nj Cash Buyers

Table of ContentsSome Known Details About Nj Cash Buyers Nj Cash Buyers for DummiesSome Known Questions About Nj Cash Buyers.The 25-Second Trick For Nj Cash Buyers

Many states give consumers a particular degree of protection from creditors concerning their home. Some states, such as Florida, entirely excluded your house from the reach of specific creditors. Various other states set restrictions ranging from as low as $5,000 to approximately $550,000. "That implies, no matter the value of your home, lenders can not require its sale to satisfy their insurance claims," claims Semrad.If your home, as an example, is worth $500,000 and the home's home mortgage is $400,000, your homestead exception can stop the forced sale of your home in order to pay lenders the $100,000 of equity in your house, as long as your state's homestead exception goes to least $100,000. If your state's exception is much less than $100,000, a insolvency trustee could still compel the sale of your home to pay lenders with the home's equity in extra of the exception. If you fall short to pay your residential or commercial property, state, or government tax obligations, you could shed your home through a tax obligation lien. Buying a home is much less complicated with money.

(https://www.pageorama.com/?p=njcashbuyers1)I know that several sellers are more likely to approve a deal of money, but the seller will certainly get the money regardless of whether it is financed or all-cash.

Some Known Details About Nj Cash Buyers

Today, regarding 30% people homebuyers pay money for their residential properties. That's still in the minority. There might be some good factors not to pay cash money. If you just have adequate cash money to spend for a residence, you might not have actually any left over for repair work or emergency situations. If you have the money, it may be an excellent concept to set it apart to ensure that you have at the very least 3 months of housing and living expenses must something unanticipated take place was shedding a work or having medical problems.

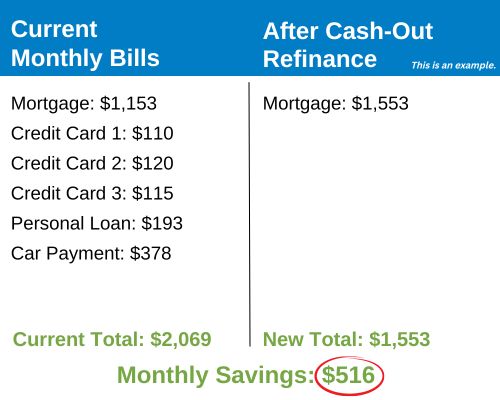

You may have certifications for an outstanding home mortgage. According to a recent study by Money publication, Generation X and millennials are considered to be populations with the most potential for development as borrowers. Taking on a bit of debt, especially for tax obligation purposes wonderful terms may be a far better alternative for your funds generally.

Possibly purchasing the stock exchange, common funds or an individual business could be a far better option for you in the future. By acquiring a building with cash money, you take the chance of depleting your reserve funds, leaving you susceptible to unanticipated upkeep expenses. Possessing a residential or commercial property involves recurring costs, and without a mortgage padding, unexpected fixings or restorations can stress your finances and prevent your capability to maintain the building's condition.

9 Easy Facts About Nj Cash Buyers Described

Home prices fluctuate with the economic situation so unless you're intending on hanging onto the house for 10 to 30 years, you could be much better off spending that money in other places. Purchasing a home with money can quicken the buying procedure substantially. Without the requirement for a mortgage authorization and associated documentation, the deal can shut quicker, providing an affordable side in competitive realty markets where vendors may prefer cash buyers.

This can lead to significant price financial savings over the long-term, as you won't be paying passion on the lending amount. Cash money buyers usually have stronger settlement power when taking care of vendors. A cash offer is much more attractive to sellers considering that it reduces the threat of an offer failing as a result of mortgage-related issues.

Keep in mind, there is no one-size-fits-all option; it's important to tailor your decision based on your individual situations and lasting ambitions. Prepared to start taking a look at homes? Offer me a phone call anytime.

Whether you're liquidating properties for a financial investment residential or commercial property or are carefully saving to purchase your dream residence, purchasing a home in all money can substantially enhance your acquiring power. It's a tactical relocation that enhances your setting as a buyer and boosts your adaptability in the realty market. It can put you in an economically vulnerable spot.

Nj Cash Buyers for Beginners

Minimizing rate of interest is one of one of the most usual reasons to purchase a home in cash money. Throughout a 30-year mortgage, you could pay tens of thousands or also thousands of countless bucks in total rate of interest. Furthermore, your purchasing power enhances with no financing backups, you can discover a wider option of homes.

Realty is one investment that has a tendency to outpace inflation over time. Unlike supplies and bonds, it's thought about much less dangerous and can provide short- and lasting wide range gain. One caveat to note is that throughout details financial markets, real estate can produce much less ROI than other investment key ins the brief term.

The greatest danger of paying cash for a house is that it can make your funds unstable. Binding your fluid assets in a home can minimize monetary flexibility and make it more difficult to cover unforeseen expenses. Furthermore, connecting up your money implies losing out on high-earning financial investment possibilities that might produce higher returns elsewhere.

Report this page